Washington voters were asked Tuesday to share their thoughts on recent or proposed taxes. The results were unequivocal.

Voters opposed by double-digit margins the three tax measures presented as advisory votes.

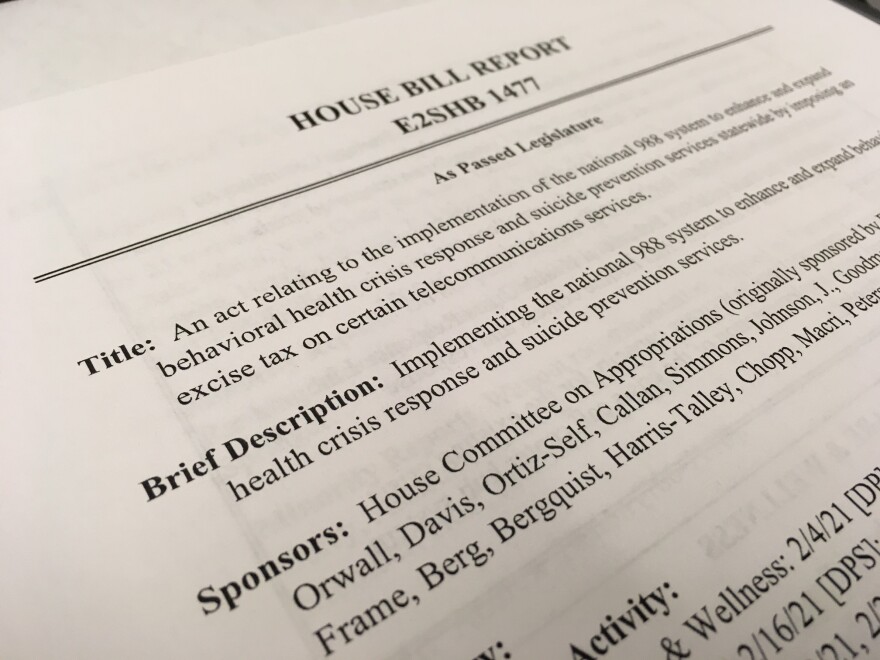

Advisory Vote 36 was about a tax on telecommunication services that's intended to fund a comprehensive suicide prevention effort called 988. The tax is projected to generate $400 million over ten years, and it began in October. Fifty-seven percent of voters who answered the question said the tax should be repealed.

Advisory Question 37 is about a controversial capital gains tax. The tax's defenders say it would apply to a small percentage of Washington households. It is being challenged as unconstitutional. And its existence was the most strongly opposed -- 63 percent of voters thought it should be repealed, and 37 percent voted to keep it.

Advisory Question 38 dealt with an issue that applies only to companies involved in creating their own casualty and liability insurance policies. The tax would help fund state regulation of the practice, called "captive insurance." Voters opposed that tax 59 to 41 percent.

In each case, voters in most Washington counties opposed the the tax measures. Only in King, Jefferson and Island counties did voters feel favorably toward any of the taxes. But the outcome of the advisory votes doesn't matter. The results do not actually repeal or keep tax measures approved by the Washington legislature.

Washington’s advisory votes were created a decade ago by anti-tax activist Tim Eyman. Legislators usually take them with a grain of salt in account of their wording, which some have complained is slanted. Lawmakers have proposed eliminating the questions from ballots or moving them to the end.