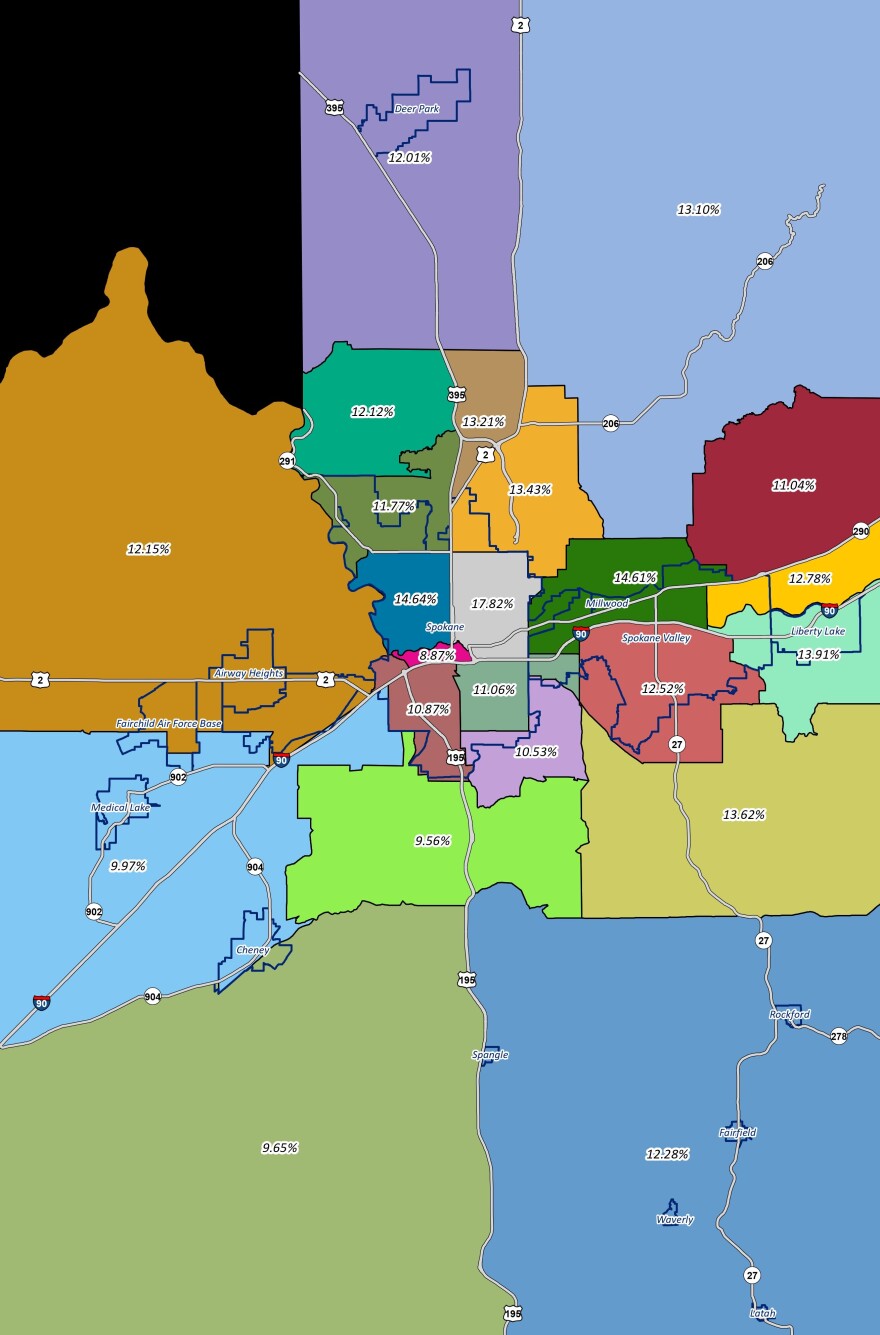

Homeowners in Spokane County saw around a 12.6% increase in their assessed value this year, with some neighborhoods in Spokane seeing significantly higher spikes in value due to the tight housing market.The biggest increases were in Northeast Spokane which saw a 17.8% hike in assessed value and Northwest Spokane, which saw a 14.6% increase. They were followed by the Millwood area which had a 14.6% increase as well and the Liberty Lake area, which had a 13.9% increase in assessed values.

Spokane County Assessor Tom Konis said the most notable increases were in the city of Spokane, but the entire county saw jumps in assessed value.

“Typically our job is to value properties at 100% of their market value, which is based on sales, and there’s just been so many sales for so much more value than there ever had been before that it’s just pushing everything up.”

Konis said assessed value changes have fluctuated over the last 15 or so years. The last 17% increase in the county was in 2008, which was followed by a 4.8% increase the next year, and a drop in assessed values for the next four years during the aftermath of the Great Recession.

Since 2014 however, assessed values in Spokane County has been steadily increases, seeing double digit increases for the first time since the recession in 2019.

Konis said the lack of supply in Spokane, was also fueling the increase in prices in smaller towns and rural areas outside the city.

“I have a friend who wanted to purchase on the South Hill, and ended up building in Airway Heights because they couldn’t find what they wanted, and couldn’t afford what they wanted.”

Airway Heights had a 12.2% assessed value increase.

Both Konis, and Rob Higgins, the executive director of the Spokane Association of Realtors, expect the increases in assessed value to continue.

“There’s just not enough supply, based on the demand that’s out there and the demand is coming from many different places.”

Higgins said there are several factors influencing housing prices beyond supply: buyers from other areas of the country that can work from home, millennials who are now approaching the phase in life where they are looking to buy a house, and baby boomers who are holding on to their properties for as long as they can.

He said other factors, such as a lack of diversity in housing supply and lack of housing at different price points is also an issue.